India is well on its way to achieving its target of 20% ethanol blending in petrol by 2025-26, reflecting the achievement of blending percentages achieved so far and increase in ethanol production capacity.

However, the food versus fuel equation is looming over the ethanol economy, as recent events show. For instance, maize imports from April to June this year have increased compared to last year, while maize has been used to make fuel ethanol to compensate for restrictions on the use of sugarcane products. However, the industry believes that India has ample surplus of grains and sugar. Tarun Sahni, vice-chairman and managing director of Triveni Engineering and Industries, says, “With large food stocks across the country, there is absolutely no concern about food security in the near future. What I worry about is that the supply and stocks are so large that it is likely to lead to wastage and spoilage,” he said.

The focus has been on first generation (1G) ethanol which is made directly from food grains and sugarcane. The government should diversify and move towards 2G and 3G which are more benign in terms of impact on food security.

Status of Ethanol Production Capacity

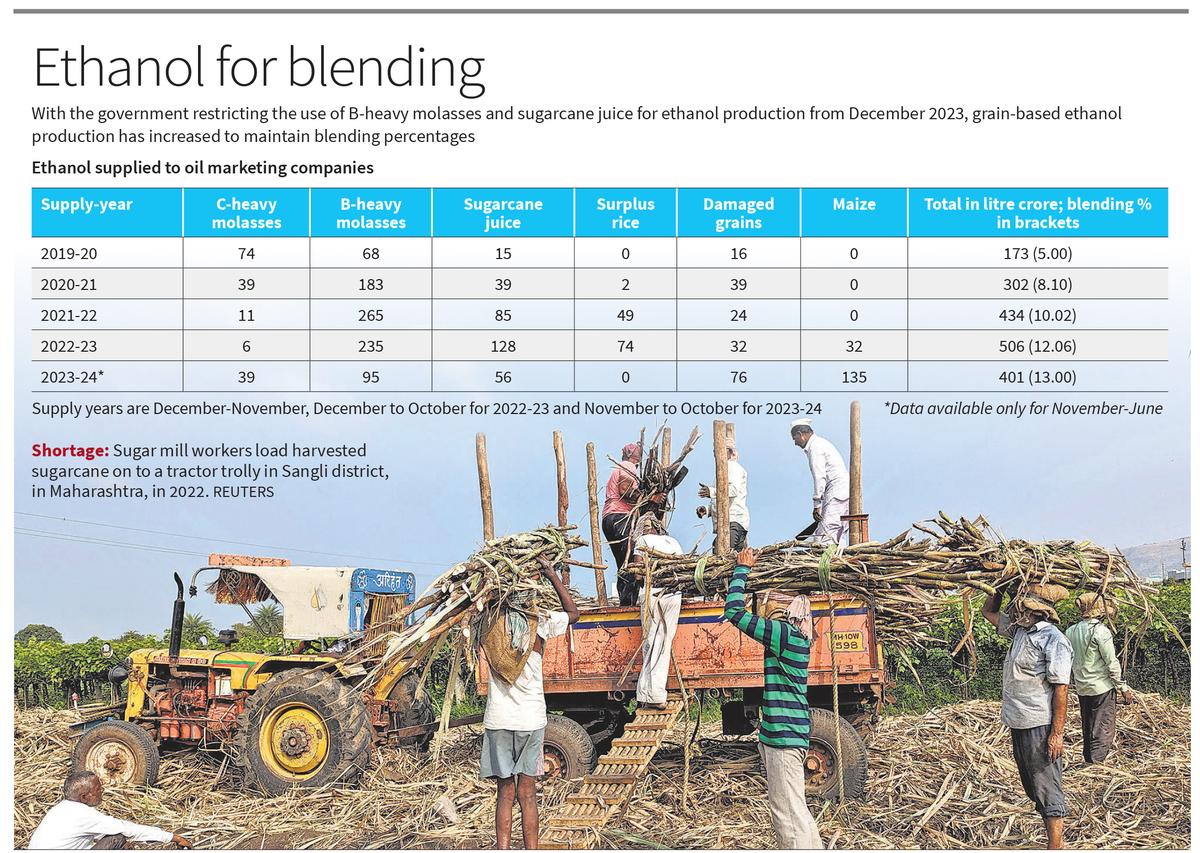

Twenty per cent by 2025-26 would mean producing about 1,000 crore litres of ethanol for blending with petrol. “We are now looking at 13% to 15% blending, with a sharp increase from 2021,” says Saurabh Banerjee, a consultant on ethanol and biofuels. In 2021, blending was about 8%. Deepak Ballani, director general of the Indian Sugar and Bio-Energy Producers Association, says the sugar industry has invested about ₹40,000 crore in capacity expansion in the past few years. In just two years, 92 crore litres of capacity was added.

The roadmap for achieving ethanol blending targets prepared by Niti Aayog had stipulated that the capacity of sugarcane-based distilleries should increase from 426 crore litres in 2021 to 760 crore litres in 2026, while that of grain-based distilleries should increase from 258 to 740 crore litres. In other words, the number of grain-based distilleries was to increase further. Apart from fuel ethanol, about 310 crore litres would be required to make ethanol for consumable alcohol as well as industrial uses. Taking stock in December 2023, the government said India’s ethanol production capacity had already increased to 1,380 crore litres – about 875 crore litres from sugarcane and 505 crore litres from food grains.

Two interest subvention programmes for setting up new distilleries have helped ramp up ethanol production capacity. The industry is demanding that these programmes should be extended to maintain the momentum and create surplus capacity for other uses such as blending with diesel and that oil marketing companies (OMCs) should sign more long-term contracts with distilleries until the supply chain is well and truly in place.

Sugarcane produces three main related products – cane juice and syrup, B-heavy molasses and C-heavy molasses, in order of decreasing sugar content. The first two are generally used to make sugar while the third is used for ethanol production. To increase fuel ethanol production, the government has started allowing the first two to be diverted from sugar production to fuel ethanol. The price of ethanol depends on the amount of sugar in the input. In 2022-23, 63% of fuel ethanol came from B-heavy molasses and 33% from molasses. In December, 2023, the government restricted the diversion of the first two due to fears of falling sugar stocks.

However, Mr Ballani believes that the restrictions will be lifted this year. He says that out of the total sugar production of 340 lakh tonnes in 2023-24, consumption was only 285 lakh tonnes. Therefore, there is some closing stock available for 2023-24, he said, adding that the fears of sugar surplus being reduced are unfounded.

The rise in sugarcane production will have to be sustained by greater water use. To maintain 50% of the 1,000 crore litres from sugarcane will require an additional 400 billion litres of water, says Souvik Bhattacharya of The Earth Research Institute. Expanding sugarcane cultivation, he says, will divert irrigation water from essential food crops, raising concerns about agricultural sustainability. To compensate for the shortfall caused by restrictions on B-heavy molasses, grain-based distilleries, mainly maize, are operating at full capacity this year to maintain blending percentages.

The government policy is that maize as well as surplus rice and damaged grains will be used to feed grain-based distilleries.

Teri’s Bhattacharya says India is a leading producer of maize globally, but domestic consumption is consistently outpacing production. In the past few years, Indian maize imports have been around 0.4 to 0.5 million tonnes annually. A rapid shift to ethanol will increase prices and negatively impact its major uses – 47% in the poultry sector, followed by livestock feed (13%) and starch (14%). At 3 to 4 tonnes per hectare, India’s maize yields are much lower than other countries, he said.

Maize production has jumped in the last few years, but commerce ministry data shows that Indian maize (corn) imports were pegged at $39 million in 2023-24. Imports have already hit $103 million from April to June this year. According to Niti Aayog estimates, about 4.8 million hectares of maize cultivation area will have to be added to meet the 20% target, which is about half the normal maize cultivation area.

On fuel efficiency in automobiles

Ethanol will not only reduce greenhouse gas emissions, but it will also prevent foreign exchange expenditure of about $4 billion per year, according to Maruti Suzuki Company’s estimate, and strengthen the rural economy by promoting the cultivation of a variety of crops through an assured market. Many automakers say the government deadline for E20 (20% ethanol and 80% gasoline) compliance is achievable, but questions remain over existing vehicles whose performance will be affected by higher ethanol content.

The Niti Aayog report said ethanol reduced fuel efficiency by an average of 6% for vehicles that were not suitable for ethanol.

Several automakers say they are in line with the government deadline of 2025. A Maruti Suzuki spokesperson told The Hindu that all Maruti vehicles are E20 fuel compatible from April 2023. Existing vehicles may have to go for engine retuning and changes to E20-supported materials depending on their grade.

How different states view this policy

Meanwhile, the growth of the ethanol economy has affected states differently. While fuel ethanol is priced uniformly across India, states fix the price of extra neutral alcohol (ENA) that is used for brewing alcohol and other uses. This pricing has been decisive in sugarcane-based distilleries choosing highly purified fuel ethanol over ENA and other forms.

In Uttar Pradesh, the government has reserved about 25% of the ethanol for ENA. Mr. Sahni says ENA is less attractive because it offers less value. Ethanol made from molasses, especially B-heavy molasses, offers significantly higher value, he said. Mr. Sahni says UP is fully aligned with the central government’s mission on ethanol. He said UP is the largest contributor to the ethanol blending programme across the country. “Most distilleries, as well as new capacities in UP in particular, are multi-fuel, allowing them to process both sugarcane juice and molasses, and grains, including rice and maize. For the coming year, it is estimated that 55% of the national requirement of ethanol will be met from sugarcane and the remaining 45% will be met by grain distilleries.”

In Tamil Nadu, which has a very lucrative market for distilleries, fuel ethanol has not yet become that popular. The state government buys and sells all the alcohol. Revenue from alcohol is one-sixth of total government revenue.

Industry sources say increasing sugarcane cultivation may not be possible because of water requirements. Broken rice may also not be made available. A highly placed government source said it would be bad politics to supply rice, even broken rice, for ethanol in Tamil Nadu as people would associate it with alcohol and protest. M. Ponnuswamy, chairman and managing director of Pon Pure Chemicals, says the government should support maize cultivation as an alternative. “Maize is not water consuming. It depletes the soil and cannot be the sole crop. It can be used in rotation with sugarcane to ensure that soil fertility is not depleted,” he says. About half a dozen distilleries for ethanol fuel are on the drawing board and are at various stages of completion. Ensuring feedstock supply could help boost the non-sugarcane distillery base in the state.

Vishal Kamat, president, Confederation of Indian Industry (CII) Maharashtra, says producing ENA in Maharashtra and supplying it for manufacturing activities, fashion and other uses such as pharmaceuticals is more profitable than ethanol blending. “All sectors except liquor are witnessing good demand, thanks to the fast-growing economy. Still, if there is a stable contract for purchase in the blend, fuel ethanol could be attractive as there will be no need for additional processing once purity is ensured,” he said.

Many people in the industry are demanding an increase in the price of ethanol.