For representational purposes. | Photo Credit: Getty Images

IIn the years before the pandemic, the world’s two largest economies – the US and India – had cut corporate tax rates in an effort to boost growth. While the pandemic dealt an unprecedented blow to the economy, we have had enough time to evaluate the effects of these tax cuts.

Effects of tax cuts in the US

The Tax Cuts and Jobs Act was signed by former President Donald Trump on December 22, 2017, and went into effect on January 1, 2018.

While the act affected individual and corporate taxes, one of the most important provisions was the reduction of the top tax rate on corporate income from 35% to 21%. Supporters of the measure believed that the move would ensure that companies would invest more, leading to growth and employment. The new investments would also lead to improvements in technology and productivity, which would also lead to higher wages.

In a recent publication entitled ‘Lessons from the Largest Business Tax Cut in American History’ (published in the Summer 2024 edition of The American Magazine) Journal of Economic Perspectives), economists Gabriel Chodorow-Reich, Owen Zidar, and Eric Zwick examined the effects of the tax cuts. They found that the cuts had a positive effect on investment, with several studies estimating an increase in investment of about 8 to 14%. Furthermore, studies show that, based on investment trends, investment would likely have declined if the tax cuts had not been passed.

This does not mean that the tax cut had an unambiguously positive outcome. It is a relatively small increase in investment, which means a long-term increase in GDP of only 0.9%, and an annual wage increase of less than $1,000 per worker. This is in stark contrast to the $4,000 to $9,000 wage increase claimed by the Council of Economic Advisers in favor of the move. Furthermore, the reduction in tax rates means a long-term reduction in tax revenue of about 41%. The fiscal health of the US economy has deteriorated at the cost of higher profits and a modest increase in wages.

On Tax Deduction in India

India had cut tax rates for corporates in September 2019, bringing the tax rate for existing companies down from 30 to 22% and for new companies from 25 to 15%. This resulted in a tax revenue loss of around Rs 1 lakh crore in 2020-21. Yet this tax could prove to be a net gain for the economy if it results in increased employment and investment.

The pandemic caused severe dislocations in the labour market, leading to increased unemployment. Unemployment has since declined, with the labour force participation rate rising, especially for women. However, the corporate sector has not contributed significantly to this growth. Most of the increase in employment has been in the form of insecure work, with the rural sector seeing a significant increase in unpaid family work. According to the PLFS, the share of workers with regular wage employment at the all-India level has fallen from 22.8% in 2017-18 to 20.9% in 2022-23. Further, when comparing the periods July-September 2017 and July-September 2022, the average nominal monthly earnings of rural and urban regular wage workers exhibit a CAGR (compound annual growth rate) of 4.53% and 5.75%, respectively, only slightly higher than the rate of inflation. In real terms, rural wages for regular employment have declined, while there is relative stability for urban wages.

This does not mean there has been no growth; corporate tax collections have seen a good increase since the pandemic. However, this has had little or no impact on employment or wages. Tech companies in India have recently made headlines for laying off employees rather than adding to their numbers.

Furthermore, tax cuts have shifted the burden of tax collection from corporates to individuals.

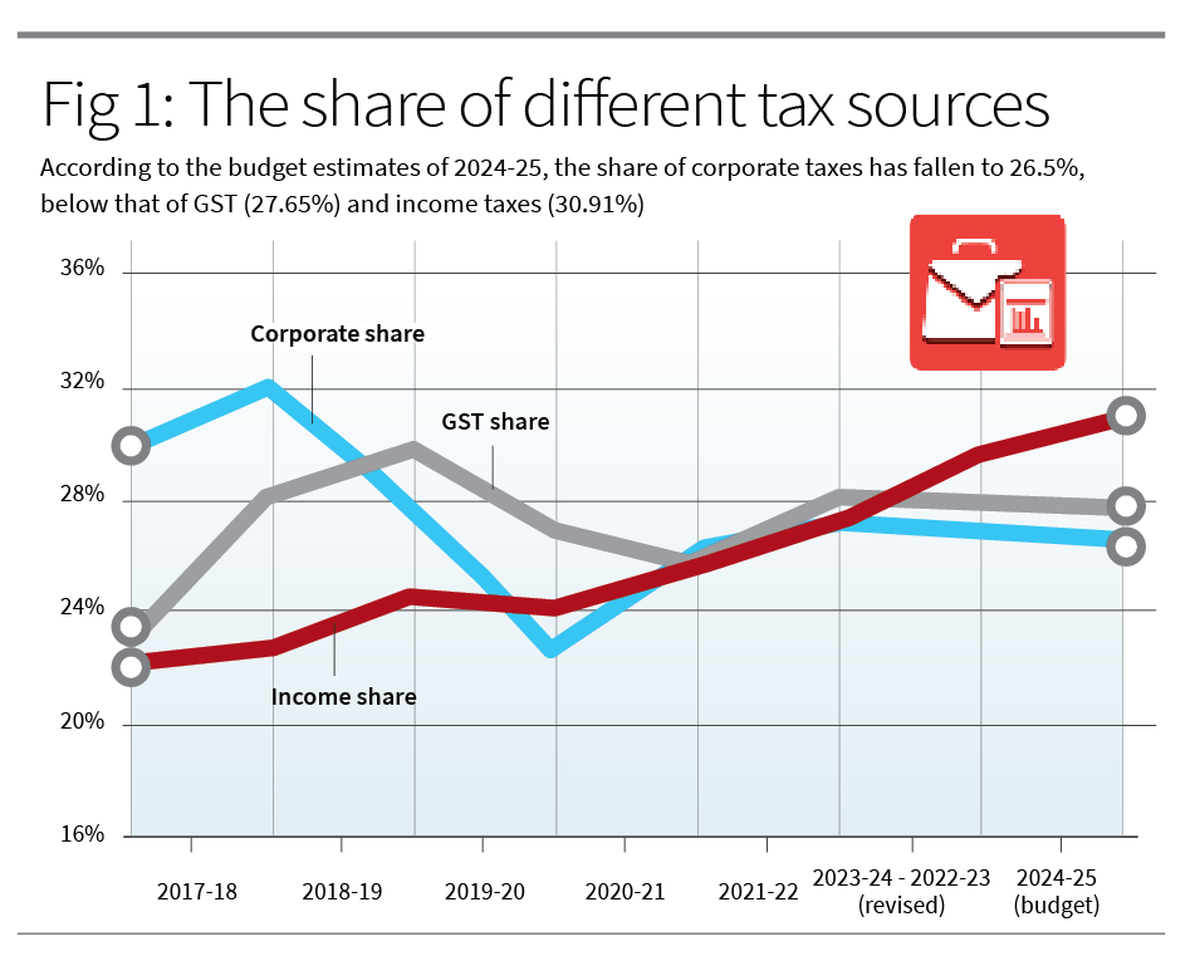

Figure 1 shows the share of the three major sources of taxes – corporate tax, income tax and GST – in the Centre’s gross tax revenue. In 2017-18, corporate tax was about 32% of gross tax revenue. It has since declined while the share of income tax has increased. As per budget estimates for 2024-25, the share of corporate taxes is projected to decline to 26.5%, lower than GST (27.65%) and income tax (30.91%).

This is perhaps why the central government has decided to remove indexation benefits and impose tax on long-term capital gains, as it tries to find new sources of revenue to compensate for the declining share of corporate taxes.

What next?

If capital feels that the prospects for future profits are uncertain, tax cuts will not boost investment. In an economy recovering from the pandemic and supply-side disruptions, tax cuts have had only a marginal impact on private investment.

Tax cuts on profits have an immediate impact on income distribution. Cutting profit taxes increases returns on capital already invested without increasing future investment, thereby benefiting private capital while providing little or no benefit to wage-earners (who will benefit only if investment leads to substantial increases in employment, productivity and wages).

Chodorow-Reich and others argue that an appropriate policy strategy would be to impose higher taxes on current profits and increase incentives to promote future investment. These tax cuts demonstrate the difficulty of policymaking in an uncertain world.

Rahul Menon is an Associate Professor at the Jindal School of Government and Public Policy at OP Jindal Global University.